Given that several industries are facing disruptive forces, it is normal for you to wonder “is my business vulnerable to disruption?”. More generally speaking, this can be framed as “are some industries easier to disrupt than others?” From an incumbent’s perspective, this is an existential question. Even from a disrupter’s perspective, this is a critical issue.

Conditions for disruption

Two conditions are critical for a disruption in any market. First, there has to be a massive change in the status quo. Second, the incumbents have to be unable to respond to this shift.

Two conditions are critical for a disruption in any market

Change refers to a change in a company’s environment that makes the company less relevant. For example, when electric cars dominate the market, an incumbent who doesn’t sell electric cars will be at a disadvantage. At the same time, change doesn’t threaten an incumbent who can adapt to that change. For example, as search moved to mobile devices, Google was able to adjust to that change. That change didn’t lead to a disruption for Google.

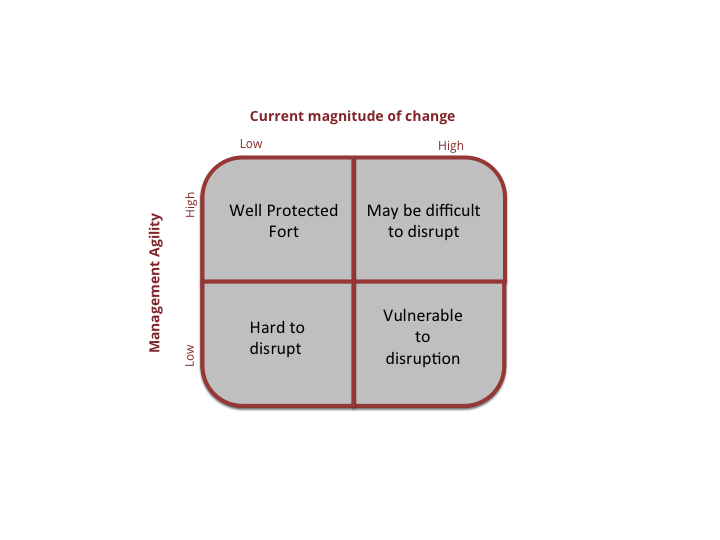

Disruption Map

Using these two conditions we can draw a two by two matrix of the world of business. The horizontal axis divides industries based on how much change is taking place in that industry. The vertical axis represents the degree of management agility. It refers to the ability of a company to adapt to change.

The bottom right box is where most disruption would take place. It applies to industries where the degree of change is high, and management agility is low. In such situations, conditions are ripe for disruption.

The bottom right box is where most disruption would take place. It applies to industries where the degree of change is high, and management agility is low. In such situations, conditions are ripe for disruption.

The top right box is also relevant. It refers to fast changing industries with high management agility. Disruption is possible there but only because of management missteps. Let’s go a bit deeper to identify what kind of companies in which kind of markets are easier to disrupt.

Drivers of change

Industry change can be modeled in many different ways. I have detailed one model in my book The Dark Side of Innovation. There I conceptualized the drivers of status quo in a cascading change model in an industry.

1. Paradigms

In that model, I imagined an industry to exists within a set of paradigms of consumers. For example, ‘taking pictures is a way of preserving memories’ is a paradigm. The camera industry exists within this paradigm. Customers and suppliers emerge within this paradigm.

2. Norms

The clients and suppliers follow some norms which provide a second level of stability in the industry. For example, film roll and cameras is a product bundle that was commonplace to buy and sell. Using photofinishing services was another norm in the industry. On the supplier side, it was normal to expect that most of the profits are made in consumables like the film roll.

3. Capabilities

The third level of stability arises from supplier capabilities that develop over time. These skills refer to key strengths that vendors develop while serving the customers.

Kodak developed three skills over time. Chemical capabilities, brand, and a distribution network. These capabilities prevent new entry in the in industry. DuPont tried to enter the film industry but wasn’t able to compete with Kodak. Kodak’s superior chemical capabilities prevented DuPont from establishing a position.

4. Offerings

Finally, the fourth level of stability is provided by the products and services being offered. Film rolls, cameras, and photofinishing services were a part of the produce offering in the the industry.

As these four pillars of stability remain constant, the industry witnesses a status quo. When they change, they can to industry change that can be minor or major.

In the case of Kodak, the product offerings changed and required a change in the capabilities of competitors. Kodak needed to build new electronics skills. This change also led to other changes in norms and paradigms.

People began to take pictures where they didn’t take pictures earlier. Images of documents and business cards replaced faxes. Sharing of images became new norms. Pictures as a communication medium became a new paradigm.

These led to a massive change in the photography industry.

Management Agility

The ability to respond to change is often a result of how much change a company has experienced in the past. If you have experienced a massive change in the recent period, you are more agile and vice versa.

Handling change is also a management capability. It encompasses much more than processes and management information systems. It also requires agility of the mind of managers. Cognitive rigidities are often harder to overcome than process and information system rigidities.

Cognitive rigidities are often harder to overcome than process and information system rigidities

As a result, a company in an industry that has seen little change for an extended period is less likely to have an agile management. But, a business in a fast changing industry is more likely to have an agile management. Therefore companies buffered by strong brands and consistent paradigms, technologies and norms may have less agile management.

Insurance, banking, and consumer goods are some such examples. These industries have not seen much change for a long time. But, enterprise software, hardware, and networking industries saw a lot of changes. Companies in these industries are more likely to have a more agile managements.

Where is disruption easiest?

Does this mean that disruption in Insurance will be easier than in operating systems? To some extent this is true. Dollar Shave Club could quickly take over 8% of the market in shave care because the industry had seen little change for a long time. Although Gillette was in technology and innovation, it was not well versed with business model changes. Similarly, Betterment and Wealthfront have had early success in investment management because the industry had not seen much change.

However, this does not mean that changing industry will always lead to disruption. The challenge for a disruptor is different in the two right boxes. In industries such as consumer goods, the challenge is to bring about a change in the industry. Adding technology to products that have had little technology is the most obvious path to disruption in such sectors.

For example, ebooks was a way by which technology was injected into a sleepy industry of book publishing and retailing. Although disruption may be easier in such sectors, the ability to bring about change is much harder.

On the other hand, disruption in fast moving industries would require either misstep by incumbents or a more radical change in the industry than what incumbents are used to.

Microsoft made a few missteps in handling the emergence of the internet, and that led to upheaval in the office productivity segment. It was a larger than normal change for Microsoft.

Conclusion

In short, disruption can take place where the pace of change is high. As a result, some industries may be easier to disrupt than others. But if the management is agile, it can prevent disruption.

[easy-tweet tweet=”Where does your business fit in this disruption map?”]

Where does your business fit in this disruption map?

Please note: I reserve the right to delete comments that are offensive, or off-topic. If in doubt, read my Comments Policy.