As a P&G investor, I have voted with the board since I first owned the stock. But in the current proxy fight between the management and the activist investor Nelson Peltz, I am voting against the board recommendations. I am voting for Nelson Peltz to get a seat on the board of directors. In this article, I share my analysis which makes the case why P&G should roll out a red carpet for Nelson Peltz.

I reiterate what a magnificent business P&G has had and how the brand portfolio has often provided it a buffer from management mistakes. I also detail how P&G has used organizational innovation to adapt to a changing world. But this mode of adaptation has not worked for it in the recent past. The analysis shows that the P&G engine is broken and management has not been able to fix the problems. As a result, P&G needs help, it needs it urgently, and it needs it from the outside.

Peltz brings the urgently needed help and should get a seat on the board. Above all, it makes the case that the upside of giving Peltz a board seat is far higher than the downside.

P&G: A Great American Business

P&G is one of the finest American businesses one can imagine. And this is because of the strong brand portfolio P&G owns. The collection consists of Tide, Pantene, Pampers, Crest, Gillette and so on. The list goes on and on; these are loved brands that can stand on their own at any time. Due to strong brand leadership, the business has enjoyed a buffer against adverse economic conditions and periods of mismanagement.

Mostly a Well Run Company With Minor Blemishes

P&G has been an excellent company with good stewardship for a long time. That is one of the reasons for its superior long term returns to investors. It has been a steady widows and orphans stock that delivered reliable and predictable returns.

Yes, there have been times when P&G has made blunders that most wouldn’t want to talk about anymore. There was a time when P&G tapped its own executives’ phones at the head quarter location. And then there was a time when it lost massive amounts of money on little-understood derivatives. Similarly, it made some business blunders like funding the Olestra launch and then writing off a large part of it. And then the series of events and actions that led to almost 50% drop in P&G stock price in the early 2000s. And yes, then there was that thing about a purpose driven growth that didn’t work out either.

In short, P&G has been well-run company endowed with a buffer from a robust brand portfolio. But it is not perfect and has made its fair share of mistakes and blunders.

A Time Tested and Well Honed Strategy

Overall, P&G has been successful for the last hundred years because most components its strategy fit together well. It focused on sustained long term performance consistently. P&G chose to be in slow moving businesses where consumer tastes persist over a long time. Categories like soap, shampoo, toothpaste, detergents, feminine care and so on have been slow moving markets. Once you are well established there, you can play ‘not to lose’ and stay the course for the long term. That is where superior brands came into play.

By focusing on innovation and consumers, across the world, P&G was able to win from the core. It built a culture that sustained this long term thinking. By hiring people with a long term perspective, molding them carefully with promote from within policy, and rewarding them for a long term commitment, it built the right culture and capabilities.

The company developed a winning dominant logic and perpetuated its success by a ‘stay the path’ thinking. You may recall a small misadventure when it tried to stray from its long held tradition in the late 1990s. Its stock price was cut into half and management changes took place quickly.

A Historical Perspective on Organizational Innovation At P&G

As a student of business history and disruption, I understand that no company can become and remain successful unless it adapts to a changing environment. P&G has done that extremely well. Although you may not think of P&G as an innovation engine, if you look at its history, you will realize that its success was based on two different types of innovations. The first and a more visible one involved product innovation. But a little less visible but equally important was organizational innovation.

It Goes Back to McElroy

P&G has been a leader in organization innovation since the 1930s. Back in 1931, a middle manager named McElroy wrote a scathing memo criticizing how the business was being run. He promulgated a new way of managing the business – one that was based on brands. That memo led to the birth of Brand management at P&G. It was one of the finest organizational innovations. McElroy eventually became the CEO of P&G in 1948.

Division and Country Structure

A great organization understands the link between structure and strategy and P&G was no exception. By 1950s, when the post war boom was in full swing, P&G built a divisional structure that allowed it to grow every category and business in the US. At the same time, in Europe, P&G created a country structure to incentivize each country manager to develop the business in the country.

Where you place P&L responsibility determines how your managers will make business trade offs. You let a brand manager manage the P&L, the trade offs will be across SKUs. You keep it at a category level, and brands would face the vicissitudes of brand based trade offs. And if you let the country manager be responsible for P&L, categories could face the trade offs.

In others words, to achieve business development of different kinds, you need a different level of P&L ownership. This is what P&G did really well. When markets were under developed, it moved to brand based P&L in the 1930s and 40s. When it needed to build each business during boom periods, it moved to division level P&L. When it needed to develop every country in Europe, it let country managers own P&L.

Organizational Innovation for Efficiency

Rampant growth leads to inefficiencies and P&G realized this in the 1980s. To eliminate those inefficiencies, it evolved towards category management. That allowed R&D to become closer to the category leadership and manufacturing to become more streamlined. By the mid-1990s, a new global structure was in place that allowed the organization to serve diverse consumer tastes across the world while innovating at the core. It was a well-developed matrix structure.

But the matrix structure creates a slow moving organization. And P&G experienced a speed disadvantage too. Its global initiatives took too long to work and it started looking for yet another structure to adapt to a changing world. P&G’s competition had become more global and speed to market was the buzzword at that time. You may recall, almost everyone was talking about speed as the new source of competitive advantage back in the 1990s.

In that era, it needed global product launch capability. Otherwise, if a new Pantene launch in North America took five years to reach Japan, its global competitors would have already prepared for it by then. It needed speed to win. And for that speed, it needed a new structure.

Organization 2005

Eventually, this search led to its latest organization structure called Organization 2005. Again, P&G was at the forefront of organizational innovation. It created a novel structure in which global business organization was separated from market development organization. Innovation was global but the market development became local. P&L management went to global business, but the market development organization led country (and region) level top line growth. The same initiative had a visionary (and one of the first in the world) move to build shared service centers to reduce costs.

The thinking was that the new structure would allow business level decision making on a global basis and market initiatives on a regional level. In the best case scenario, enlightened business managers would focus on profitable growth while market organizations would focus on best growth avenues. They would all come together for an ideal profitable growth that is in the best interests of the business and shareholders.

But there was a dark side of this structure too: In the worst case scenario, there would be a deadlock and politicking. If I am being measured on a business’ profits and you are being measured on its growth, we may disagree more than we agree! And thus this structure required consensus building. If managers took too long to build consensus or behaved like politicians, the business would suffer a massive drag.

Organizational Innovation Worked Until It Stopped Working

In short, P&G has focused on not only product innovation but also on organizational innovation. Technology allowed it to provide superior value to the business while organizational innovation allowed it to continuously adapt to an ever changing environment.

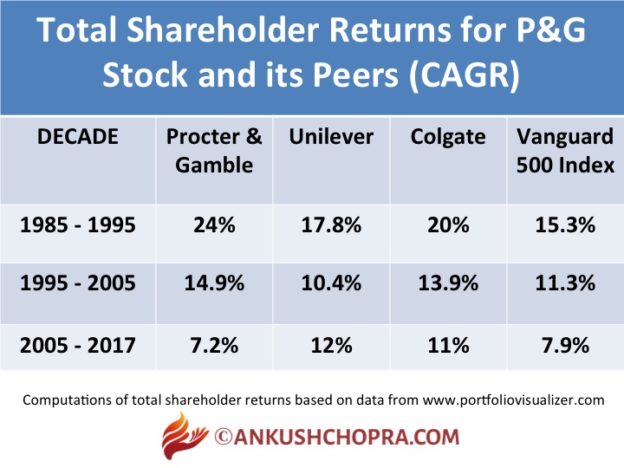

The data below will point to the fact that P&G delivered superior results until organization 2005. But since 2005, it became a sub par company from total shareholder return perspective.

P&G Performance

I pulled some data on historical shareholder return for P&G and its competitors and compared it with S&P 500 returns. To get a long term shareholder view perspective, I chose ten year periods over the last 30 years. For this exercise, I used portfoliovisualizer.com to calculate returns. Some of Unilever and Colgate data was missing in the early 1980s, but the data is still useful for long term comparison purposes.

What does the data show?

You will notice that P&G was the shining city on the hill in the first decade. From 1985 to 1995, it delivered superior returns compared to its close competitors like Colgate and Unilever. It also surpassed returns compared to S&P 500.

Look at the second decade, and you see the same results. Although the total returns declined across the board, P&G returns surpassed those of its peers.

But in the third decade from 2005 to 2017 you will notice that P&G fell behind Unilever and Colgate. It also fell behind S&P. Its performance has been sub par. It became a below average performer.

Is P&G Following the Path of Kodak?

As a student of disruption, I have studied many successful companies rise to their peak and follow a gradual decline into an abyss of irrelevance. In my book The Dark Side of Innovation, I shared research on many such companies. And it is from this perspective, I concluded that P&G needs help, needs it urgently, and needs it from the outside.

Kodak’s Demise

Kodak was a very successful company. There was a time when it could do no wrong. Every successful company believes the same notion. But I have explained it elsewhere that market success is a result of a dominant logic that works in an environment. When that logic becomes irrelevant, companies begin to erode their competitive advantage. That’s what happened to Kodak. It continued to believe in its intrinsic value and inherent capabilities. Unfortunately, the world was changing fast. When competitors were bringing the digital camera to the market, Kodak was bringing ways to convert pictures into CDs. Due to its insular culture, it ignored what was happening in the world.

Even the right CEO couldn’t save it

The board of Kodak did the right thing in hiring George Fisher to run the company. After all, photography was becoming a hardware business. And Fisher had experience in running Motorola. Even when Fisher knew what to do, he wasn’t able to steer Kodak toward the right path. It was due to a massive internal resistance that Fisher failed. Strong cultures with a history of success can sometimes lead to this hubris.

The Real Reason That Kodak Failed

The reason Kodak failed, or for that matter any successful company fails, is that it was not able to adapt to a much-changed world. In my book A Sixty Minute Guide to Disruption, I touch upon various reasons why companies fail to change. When the world around a company changes faster than it is used to, it often fails to adapt. Strong brands and massive competitive advantage only act as a temporary buffer that delays the inevitable.

Is the sustained underperformance of the stock telling us that P&G may go the Kodak way? If nothing is done fast to turn around the situation, that may very well be the case.

Has the World of P&G Changed in a Major Way?

Twenty years back, it would have been hard to imagine that consumers would change their tooth paste or a shaving blade brand regularly. A few years back I asked my MBA class how often do consumers change their staple brands? I was a bit surprised to see that most students agreed that they changed their toothpaste, detergent and shaving blade brands on a regular basis. That was in Switzerland where Aldi had changed consumer preferences with its price initiatives. Similar forces are at work all over the world.

Not only are consumers changing, even the nature of competition has changed massively for P&G. Just consider how quickly Dollar Shave Club took over an 8% share of shave care market. P&G is used to moving slowly, and devaluing threats like Dollar Shave Club. It wasn’t able to do much while Unilever quickly picked up this entry point into a hitherto difficult-to-enter market. And now P&G managers must be figuring out how to deal with an even bigger threat.

Is this the first time that P&G’s environment has changed? Not at all. All through the history, P&G managed to adapt to a changing environment. The historical returns data shows that irrespective of what changed for P&G, the company adapted to that change. But for some reason what worked for P&G in the past has now stopped working.

What’s Wrong With P&G?

I can come up with many theories on why P&G has become a subpar company. I can point to the new structure that came about in 2005, or to a faster changing world, or an excessive internal drag. One can even point to a lack of innovation. Maybe the reason is a mix of all of the above.

Every company goes through periods of immense challenge at some point. That is hardly surprising. This is not the first time P&G has had such an issue. In early 2000, P&G had a major crisis, but the board moved fast. John Pepper came back from retirement and stabilized the ship. The same happened more recently when Lafley returned from retirement to take over the reins from Bob McDonald. But this time, there was no turnaround. Lafley sold a lot of businesses he had himself bought in the previous decade to turn around the company. It didn’t work. The P&G’s shareholder returns are still lagging its peers.

Since 2005, we saw three CEOs leading P&G. In spite of their combined efforts, shareholders have seen very little output. The board has done its very best. But there has been insufficient results. The repeated assurances from the management in earnings calls sound a bit more hollow with each quarter passing. You can read a detailed analysis of what is wrong with P&G from Peltz’s perspective too.

A Critical Take Away

My take away is that either the management doesn’t know the problem or is incapable of delivering a solution.

So what is the most obvious thing to do when you cannot solve a problem yourself? You take help. That is the simplest possible thing to do. Take help!

Peltz May be the Knight in A Shining Armor for P&G

Nelson Peltz’s company has taken a substantial position in P&G and is offering that help. He is seeking a board seat to help turn around the company.

But the P&G management and board have taken a position that they won’t allow him a board seat because he doesn’t have any new ideas. They are willing to learn from him if he offers any new ideas. Management and the board have maintained that they are already fixing the business and do not need to be disturbed.

And to fight this proxy battle, P&G has spent over 100 35* million dollars. Some estimate that the actual spending may be significantly more. I cannot remember when was the last time I received so much printed materials from P&G as a stock holder. I cannot remember when was the last time I searched PG in Google and got paid advertisements on P&G in my result! And these advertisements are not selling me P&G brands but are asking me to vote against Peltz.

The Nelson Peltz Plan

Peltz has studied the issues at P&G and is suggesting a three fold path forward. First, he wants to simplify the structure and make business managers more accountable. Second, he intends to fix the broken innovation system. Third, he wants to fix an insular culture of P&G. These appear moves in the right direction.

What prevents P&G management from following the Peltz plan on its own?

One may question as to why can management not do these things on its own? I have three reasons for this.

First, some of these proposals go against the grain of P&G. For example, getting 25% of senior leaders from outside is something P&G may be incapable of doing on its own.

Second, the management has had fifteen years to turn around the company. If it hasn’t been able to do so over three CEOs, it may not be able to get this done.

Third, sometimes we are stuck in the wrong rabbit hole, and we need someone from the outside to pull us out of that hole. Otherwise, we may just keep digging.

At the same time, I have no idea whether Mr. Peltz can certainly solve the problem for P&G. But I see no harm in taking his help. After all, he has invested a large part of his investment portfolio into one stock and has taken a lot more risk than anyone else. He has not been known as a corporate raider who looks for short term results over long term performance. And above all, he has the right experience in corporate turnaround.

What’s the Real Downside of Having Peltz on P&G Board?

So what is the downside here? Based on management’s rationale, I see two major arguments.

First, he may come up with some really bad ideas. Since he has no understanding of the P&G way, his ideas may have no merit at all.

So what? As a board member, he can suggest, but the rest of the board can override any of his ideas.

Remember this battle is not to make Nelson Peltz the CEO of P&G but to just give him one board seat.

Second, he may be a major distraction for the good work that David Taylor is already doing. Now, this may be a problem.

But remember, just because Trian partners (Peltz’s company) fails in this proxy fights doesn’t mean it is an end of all proxy fights. In fact, many more proxy fights may come soon. Wouldn’t that be a bigger distraction? In fact, there may be more investors swooping in if a turnaround doesn’t take place soon. They may have a short term profit objectives and no long term commitment to P&G. Things may get even worse for the management and the shareholders.

If Peltz gets on the board and fails, there is a higher chance of avoiding future proxy fights. At that time, the board and the management would have the moral authority to say “ we tried it but it didn’t work.” At this point, they have no moral authority to say so.

So there is really not much downside to Peltz getting a seat on the board. Given the significant upside and limited downside, I think David Taylor, the board of P&G, and the share holders should all roll out a red carpet for Nelson Peltz. This is why I am voting for Peltz to get a seat on the board of P&G.

Key Take Away

This is a critical time for P&G. Even if it wins this proxy battle, as long as it sustains sub par performance, there will be other activist investors. There is very little evidence that the company can fix its issues on its own. Fighting proxy battles may be a bigger distraction than letting Peltz come in and give his best help. It is a no brainer to take help at this stage.

I voted for Peltz based on my analysis above. On what basis are you voting?

____

* Earlier estimates in media reports suggested a $100 MM spent on this proxy fight by P&G. After the publication of this article, David Taylor appeared on CNBC and said that the cost is closer to $35MM. Since it is an ongoing cost, we will find out the final numbers afterward. The point here is that P&G is spending quite a lot of money on this proxy battle.

Please note: I reserve the right to delete comments that are offensive, or off-topic. If in doubt, read my Comments Policy.