Will Amazon’s acquisition of Whole Foods disrupt the grocers? Soon after the news became public, the stock market punished the grocers. Many observers jumped to the conclusion that disruption of grocers is now inevitable.

As a student of disruption, I don’t see a disruption of Grocers as an inevitability. In my research, I found that disruption is never guaranteed. If the incumbents react appropriately, they can survive even an existential crisis. So the big question is whether Amazon can succeed in a USD 800 bn industry with a 14bn acquisition?

The Bottomline

In my analysis, this is a risky move for Amazon with more upside than downside. It is also true that grocers have an uphill task here. But there is no guarantee that Amazon will succeed here or that Grocers are now finished. Consumer packaged food companies have a lot to lose here, perhaps even more than Grocers.

Cascading Change Model To The Rescue

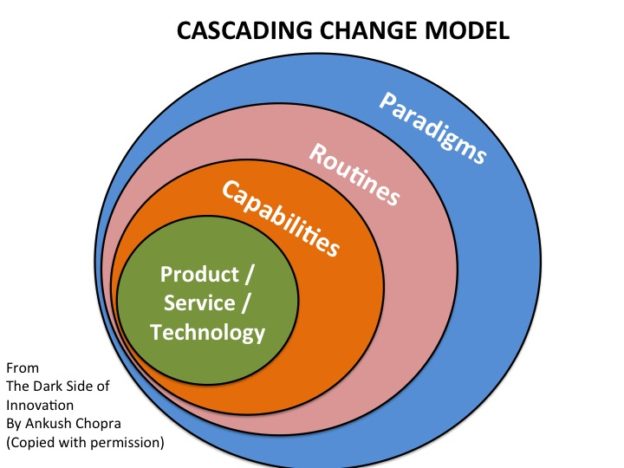

Let’s use the cascading choice framework to analyze the Amazon-Whole Foods deal. I developed the framework in The Dark Side of Innovation. In A Sixty-Minute guide to Disruption, I used it to anticipate change in more industries.

The model conceptualizes change at four different levels. Consider the four levels as four concentric circles. At the heart of the circle is the product/service/technology in the industry. The next circle is firm capabilities. The third one is routines, and the outermost circle is paradigms. Change can take place at one of more of these levels.

Most people register product / technological change. It is the easiest innovation in this model. Capability based innovation comes next, and it involves a player bringing or developing a new capability. A new way to distribute a product is an example of capability based innovation.

The third circle is all about routines. Routines refer to patterns of behavior in consumers and suppliers. Buying in a store is an example of a consumer routine. Moving to buying online is a change in routines.

The outermost circle is the paradigms or worldview within which an industry exists. Microsoft brought in a new paradigm of the office work with a PC on every desk.

If you like to know more about this model, you can also listen to my podcast on anticipating change.

Amazon’s Impact on Grocers

What does Amazon – Whole Foods deal change in the Grocery industry? Amazon brings a new set of capabilities. An efficient consumer driven logistic system and data analytics to predict and serve micro level demand.

In fact, Amazon built these two capabilities and revolutionized book retailing. And then it used these abilities to do the same to retailing across categories. These skills led to a change in consumer routines. People are buying online increasingly.

What will Amazon do to Grocery shopping? If Amazon has its way, it will deliver grocery bundles customized to our exact needs. It would deliver such bundles conveniently at our front door – without an intermediary.

Imagine this scenario: you want to prepare chicken Provencal today, and you miraculously have all the ingredients in place, in your kitchen waiting for you. Herbes De Provence box came in the previous week’s Amazon delivery. The chicken pieces arrived this evening. Garlic, tomatoes, and onions came three days back. And all this happened without a single person getting involved in this chain. The algorithm knew your needs. The efficient logistics system delivered all these in the most efficient manner possible.

And what about the Grocers in that case? Well, they are looking at alternative uses for their retail space. They may have something to learn from Staples who went through the same cycle a few years back.

The Barriers For Amazon

The above scenario is an ideal one for Amazon but to get there is a tall order. Let’s look at a similar situation in another industry and assess if Amazon can replicate that success here.

There was a time when people wondered if the Netflix model would work. After all, people really wanted to watch movies at whim and thus went to the store to get what they needed. Instant gratification was the key. Blockbuster thought that no one would want to pre-plan their movie watching.

It turned out that Netflix had figured something about the consumers. It estimated that people can forego instant gratification in some situations. When offered equally appealing titles, people were happy to accept alternatives. I am not sure if Netflix predicted this consumer behavior or shaped it. On most days I tend to think that Netflix shaped this behavior.

When it comes to grocery shopping, Amazon will have to do the same. Not sure about you, but if you ask me what I want to eat tomorrow, I will give you one of the least accurate forecasts. I am not in the minority here. So even if I say Chicken Provencal right now, I may not feel like eating it tomorrow.

The core issue for Amazon is whether people can behave the same way for food as they behaved for their consumption of movies. If Amazon succeeds in changing this habit, it would have changed Grocery market for good. People will be willing to trade off the hassle of going shopping in the store in place of getting the exact ingredients for a recipe they plan to make. Will consumers accept Italian Chicken in place of Chicken Provencal? Especially if it means no planning and pre-ordering?

How many people will fall into this category and how fast can Amazon change this behavior will be the key to Amazon’s success.

The Response of Grocers

The Grocers may think that home delivery and data analytics is something they can easily add to their menu of capabilities. You may have seen this response many times in your career. If a competitor does A, most people say we can also do A. But if Grocers did that, they will be wrong.

Playing Amazon’s game on Amazon’s turf is the wrong thing to do. Why? When you play your opponent’s game on their turf using their rules, you are likely to lose. Go back to how Coke reacted to the Pepsi challenge and you will realize what a major mistake it was.

So what can they do here? My research on disruption, from the Dark Side of Innovation, provides two lessons for Grocers.

First, they should neither underestimate nor overestimate the threat from Amazon. Others who have made this mistake paid dearly for it.

Second, they need to create an option C. I gave many examples of options C in the Dark Side of Innovation.

The Threat to Branded Consumer Food Companies

While this deal appears to be a duel between Grocers and Amazon, it affects another set of companies too. Consumer branded companies like General Mills and Kelloggs stand to lose here. And I am not even going near the types of Blue Apron.

There was a time when entry into the food and consumer goods was impossible for a small guy. But take a look at the shelves in your supermarket when you visit next. You will find a large number of lesser known or unknown brands of organics and locally produced goods.

In the last ten years or so, people began to talk a lot (online) about the issues of ingredients in mass-produced food items. That allowed an entry point to a large number of locally produced food providers. And this shows up in the bottom line results of those big consumer companies. If you are surprised, take a look at the revenue trend of the major consumer branded companies.

Amazon can provide further fuel to this fire. Linking local producers and providers with customers using an efficient logistics system can be a major blow to the larger foods companies. Not to forget that Whole Food’s own private label products would fit well in this chain. The threat to branded food and consumer packaged goods is very real.

Again this is not guaranteed if consumer goods majors can create the right response. But can the branded food majors create the right option C?

The Takeaway

What happens if Amazon fails in making such a dramatic change? It loses 14Bn which is a drop in the ocean for Amazon. But if it succeeds, it can make a significant dent in a USD 800 billion industry. It is an asymmetric risk /return game for Amazon.

But, Grocers stand to lose a lot here. And if they succeed, they get to survive and live to fight another day.

Neither the success of Amazon nor the failure of Grocers is a given. Keep an eye on how Grocers respond. If you see news items on new logistics and data analytics at major grocers, you know Amazon is winning.

The ball is in the Grocers’ court now.

Please note: I reserve the right to delete comments that are offensive, or off-topic. If in doubt, read my Comments Policy.